April 3, 2019

Adult children are moving in with their parents, and affecting their home-buying preferences—but baby boomers, who have conventionally driven the trend, are not the only generation to be impacted by it, according to new research.

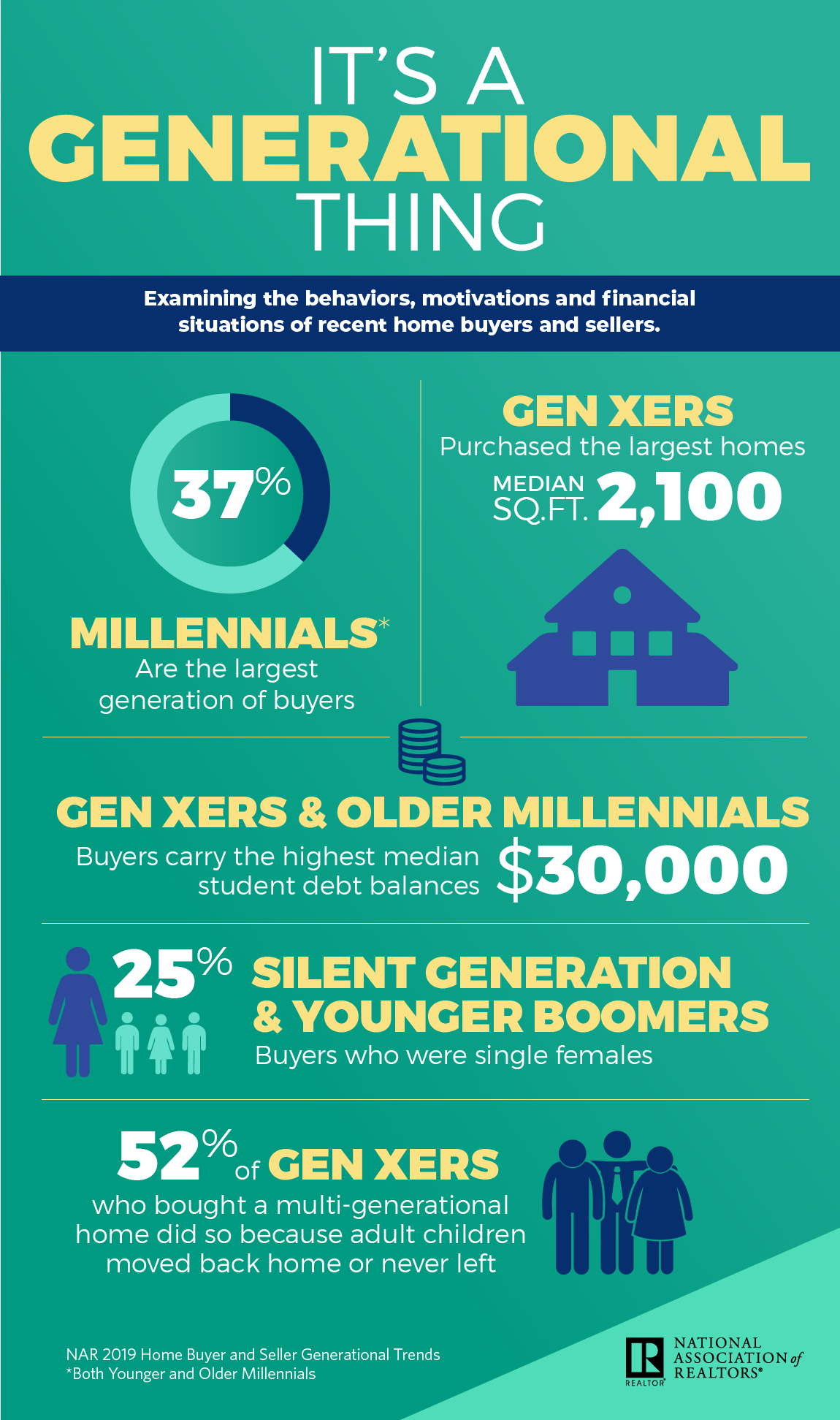

In fact, to accommodate boomerang kids, one in six Generation X homebuyers (born between 1961-1981) went the multigenerational route, and 52 percent did so because their adult children live with them, according to 2019 Home Buyer and Seller Generational Trends by the National Association of REALTORS®, a newly released report.

“The high cost of rent and lack of affordable housing inventory is sending adult children back to their parents’ homes either out of necessity or an attempt to save money,” says Lawrence Yun, chief economist at NAR. “While these multigenerational homes may not be what a majority of Americans expect out of homeownership, this method allows younger potential buyers the opportunity to gain their financial footing and transition into homeownership. In fact, younger millennials are the most likely to move directly out of their parents’ homes into homeownership, circumventing renting altogether.”

Additionally, 9 percent of millennials—on the older side of the spectrum—bought a multigenerational property, but to accommodate aging parents and spend time with them, the report shows. Millennials (born between 1981-1996) are the biggest buyer group, at 37 percent, followed by baby boomers at 32 percent and Gen Xers at 24 percent. On the selling side, Gen X is the biggest group of home sellers, at 25 percent.

Comparing early millennials to younger ones, the former’s income is $101,200, and buying homes priced at $274,000—aligning with boomers, who bring in $102,300 in income and buy at $251,100, and Gen X, who earn $111,100 in income and purchase at $277,800, according to the report.

“Older millennials are now entering the prime earning stages of their careers, and the size and costs of homes they purchase reflect this,” Yun says. “Their choices are falling more in line with their Gen X and boomer counterparts.”

The average earnings are far less for millennials who are younger, at $71,200, which is affecting their budget for buying a home—by comparison, their median price is $177,000. College debt is a factor for 47 percent of millennials who are younger, with 61 percent delaying home-buying as a result—but only by a median two years, which is fewer than other generations. Twenty-six percent cite the down payment as their largest obstacle.

“These buyers are the most likely to receive some or all of their down payment as a gift from family or friends, usually their parents,” says Yun. “This could explain why their debt is not holding them back from homeownership as long as other generations, who are less likely to receive down payment assistance.”

In addition, downsizing is falling out of favor, and baby boomers who do downsize are not making that significant of a shift: shrinking 100-200 square feet. With the movement toward multigenerational picking up steam, downsizing is now potentially unwarranted, the report states.

Whichever generation, 92 percent enlisted the help of a REALTOR® when selling.

“Consumers of all ages understand that working with a REALTOR® is the advantage they need to compete in this fast-moving, constantly evolving real estate market,” says John Smaby, NAR president. “Buying a home is an exciting, complicated and sometimes daunting process, and REALTORS® have the knowledge and expertise to guide buyers and sellers through this experience.”

Are you looking to buy a house? Check out some of Silver Linings beautiful homes on the market or fill out the form below.