What is an Adjustable-Rate Mortgage?

February 26, 2019 When buying a home, many of us will require financing to make the purchase. There are several types of loans available to you. An ARM – or Adjustable-Rate Mortgage – is popular for its low-interest rate, but be careful. There is a catch. Understand what you are getting into when obtaining an ARM. What is an adjustable-rate mortgage? Let’s find out.

When buying a home, many of us will require financing to make the purchase. There are several types of loans available to you. An ARM – or Adjustable-Rate Mortgage – is popular for its low-interest rate, but be careful. There is a catch. Understand what you are getting into when obtaining an ARM. What is an adjustable-rate mortgage? Let’s find out.

Increasing demand for ARM’s

The Washington Post reported that more home buyers are turning to adjustable-rate mortgages, because of the low initial rate of an ARM.The interest rate of an ARM is lower than the rate for a 30-year fixed-rate loan.

According to the latest Origination Insight Report from Ellie Mae, the percentage of borrowers who selected an adjustable-rate mortgage rose to 8.2 percent in October of 2018, which is up from 7.2 percent in September of 2018. Ellie Mae is a technology platform serving the mortgage industry and issues these Origination Insight Reports every month.

What is an adjustable-rate mortgage?

When you borrow money to purchase a home, you can chose to have a fixed-rate or an adjustable-rate mortgage. A fixed-rate mortgage will have the same interest rate for the entire term of the loan. Many loans today have a term of 30 years. You often hear people refer to a 30-year fixed loan, which is a mortgage with the same interest rate for 30 year until the principle amount of the loan is paid in full.

With an adjustable-rate loan, you have an initial interest rate at the beginning. However, the interest rate changes – often referred to “adjusting” – after a certain period of time. This can be one year or more, depending on the loan product. Talk to a loan officer to discuss your options.

Here is a breakdown of a few common types of ARM products:

7/1 ARM:

This loan has a fixed interest rate for the first 7 years, and then adjusts every year after that based on the current market conditions.

5/1 ARM:

This loan has a fixed interest rate for the first 5 years, and then adjusts every year after that based on the current market conditions.

1-year ARM:

This loan has a fixed interest rate for the first year, and then adjusts every year after that based on the current market conditions.

When does it make sense to get an ARM?

If you know you are going to move before your ARM adjusts, then getting an ARM makes sense. The number one reason Millenials and Generation Z moves is a change of employment with an increase in pay. Millennial job habits commonly include changing jobs within two years. With mobility being a growing trend, then having a long-term, fixed-rate loan may not be desirable. The key is to not catch yourself in a buyer’s market with home prices on the decline. You may end up being forced to sell for a lower price that you would want, due to your need to move.

If interest rates are dropping, then it can be to your advantage to get an ARM and let it adjust to a lower rate. However, it’s hard to predict interest rates. Interest rates have been on a steady climb since 2015 and it has been slowly hurting people’s view of the housing market. The higher the rate, the higher the monthly payment on the loan, so the less attractive buying a home appears. However, recently, there has been a six-week decline in interest rates, so home buyers are seeing their window and getting back into the market.

If you can afford to pay off your loan in a short time – like 10 years or less – then it may make sense to get an ARM to take advantage of the lower rate to save money in interest payments.

Know the LIBOR

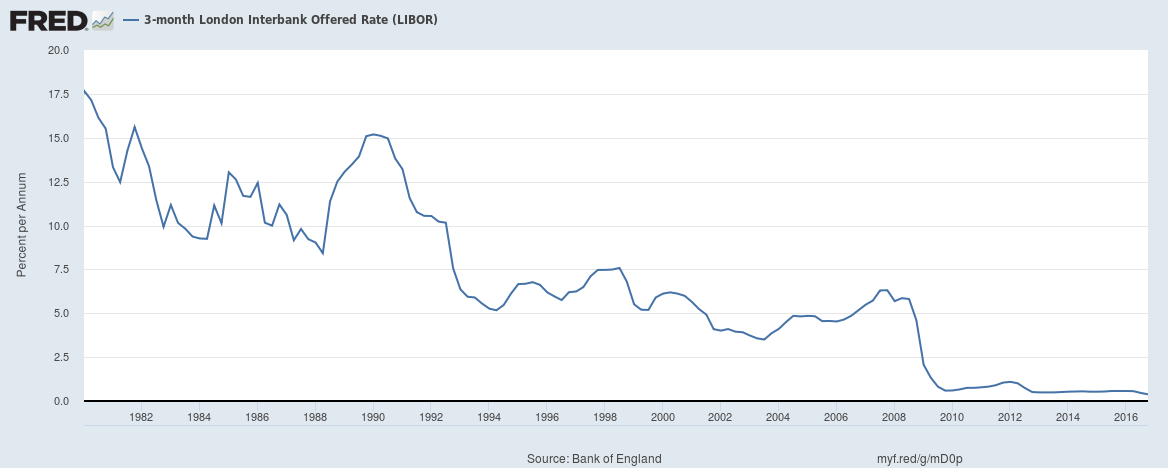

The London Interbank Offered Rate (LIBOR) is the average interest rate at which leading banks borrow funds from other banks in the London market. LIBOR is the most common global reference rate for short-term interest rates. When an ARM adjusts, the LIBOR sets the new interest rate for many loans.

Below is a 3-month LIBOR chart. You can see that since 1980, the global trend is of interest rating falling. Many people think we are in a time of prolonged, low-interest rates. However, we are also in a time of volatility. All it takes is one global event to throw things out of wack and rates could rise. A housing market crash can happen again and will catch many of us by surprise.

Have you had a good or bad experience with an adjustable-rate mortgage? If so, leave a comment below.

See original post by Gavin Grant at “https://realestblog.com/2019/01/11/what-is-an-adjustable-rate-mortgage/”